Max 2025 Fsa Contribution

Max 2025 Fsa Contribution. The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). 2025 max fsa contribution limits 2025.

An fsa contribution limit is the maximum amount you can set aside annually from your paycheck to fund your. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

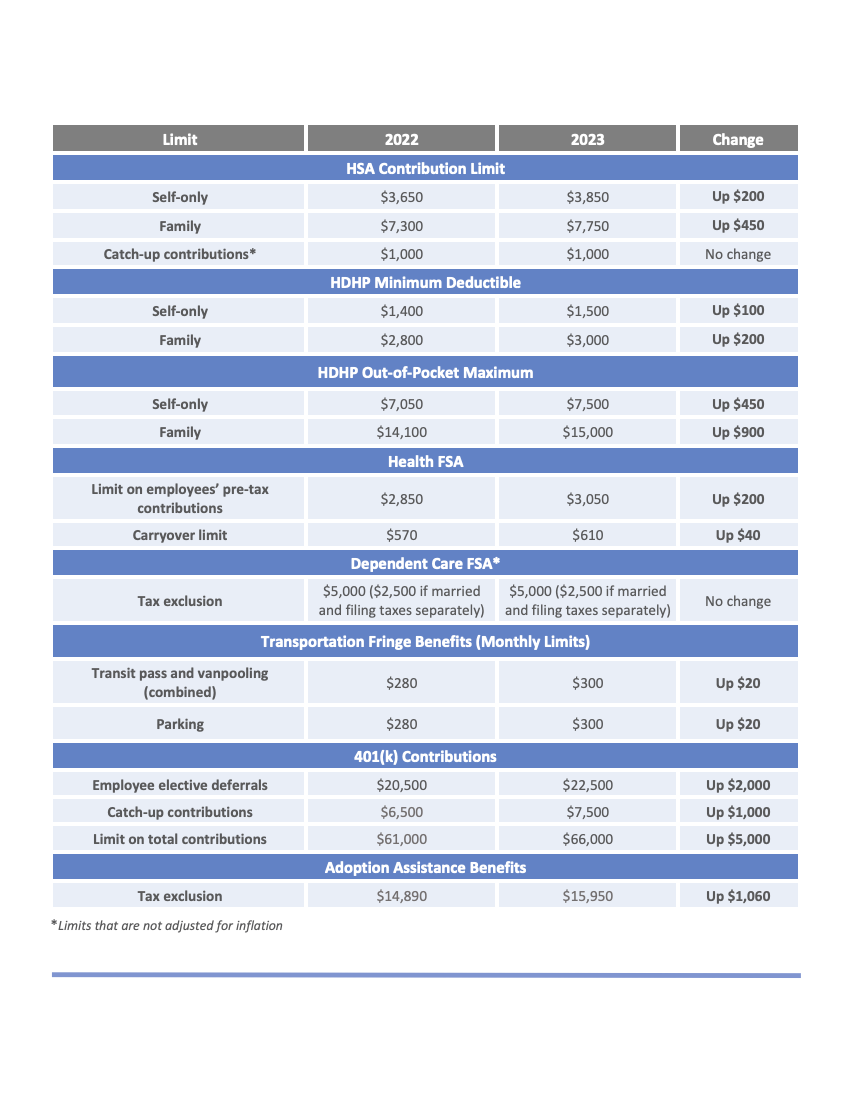

Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2%.

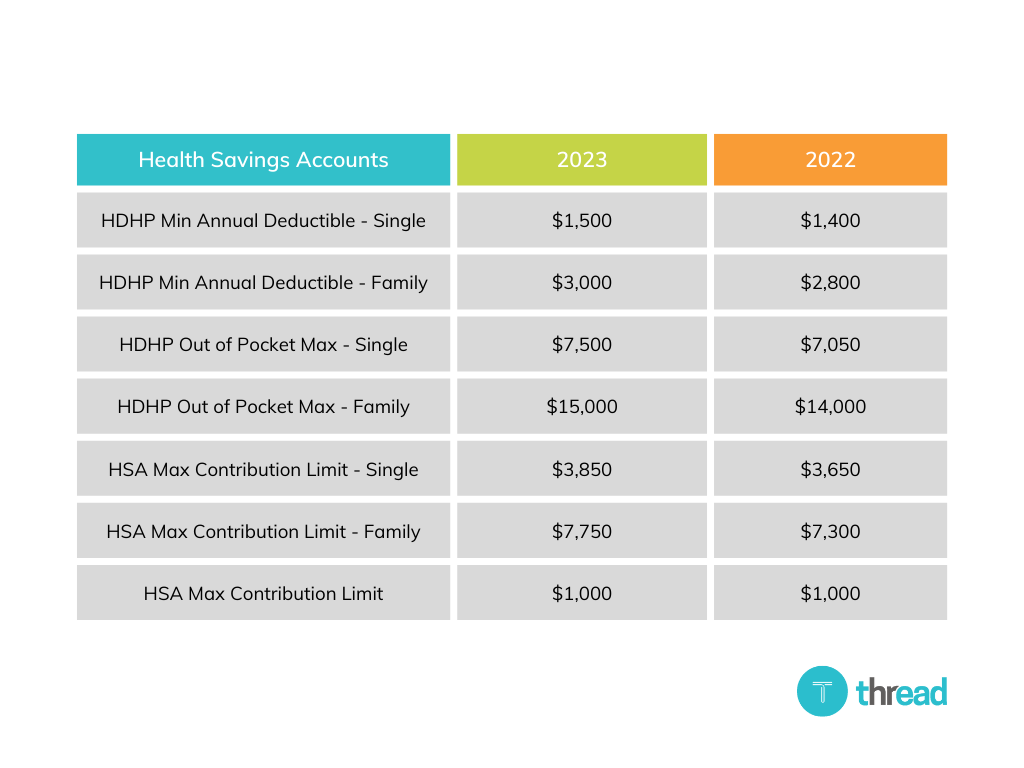

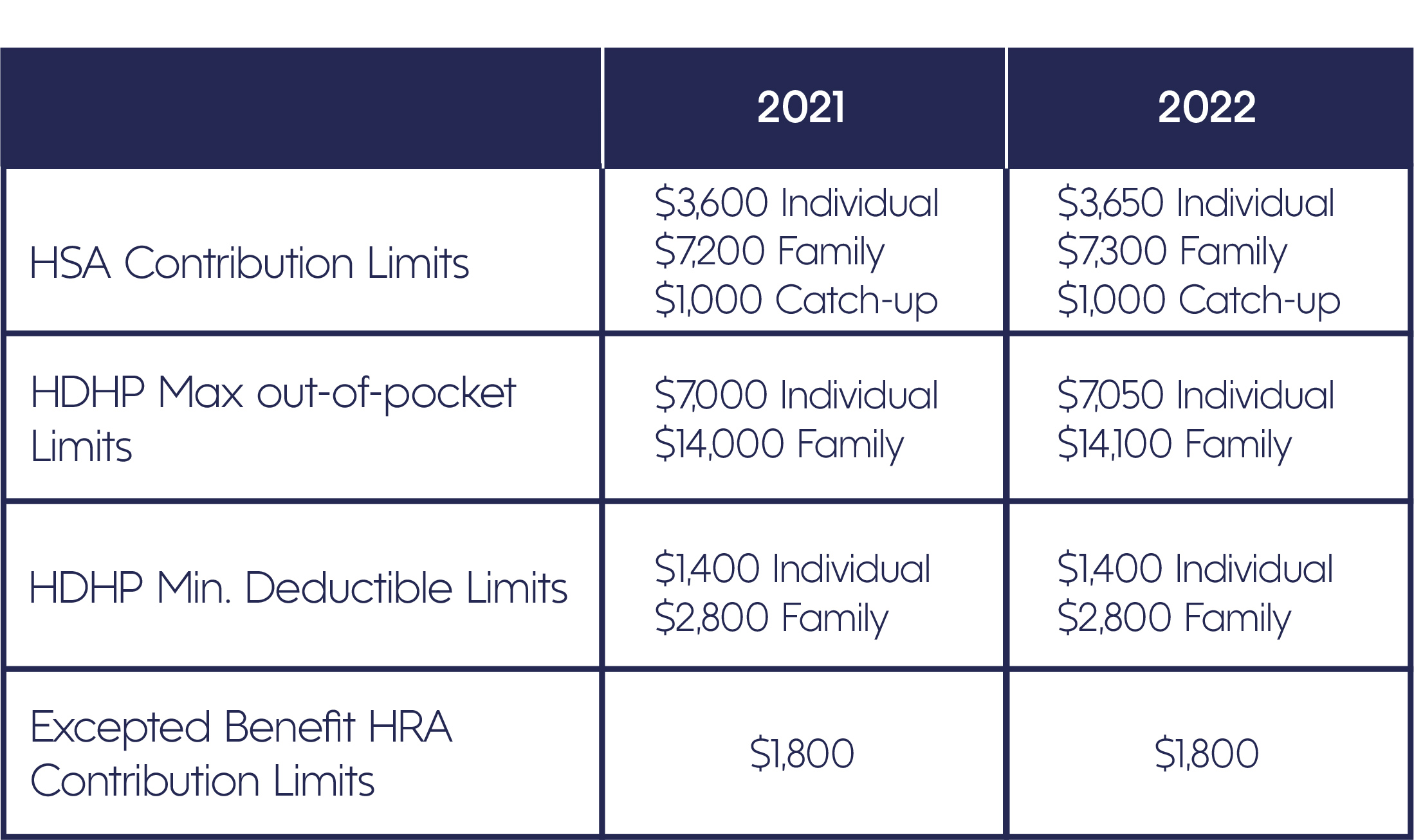

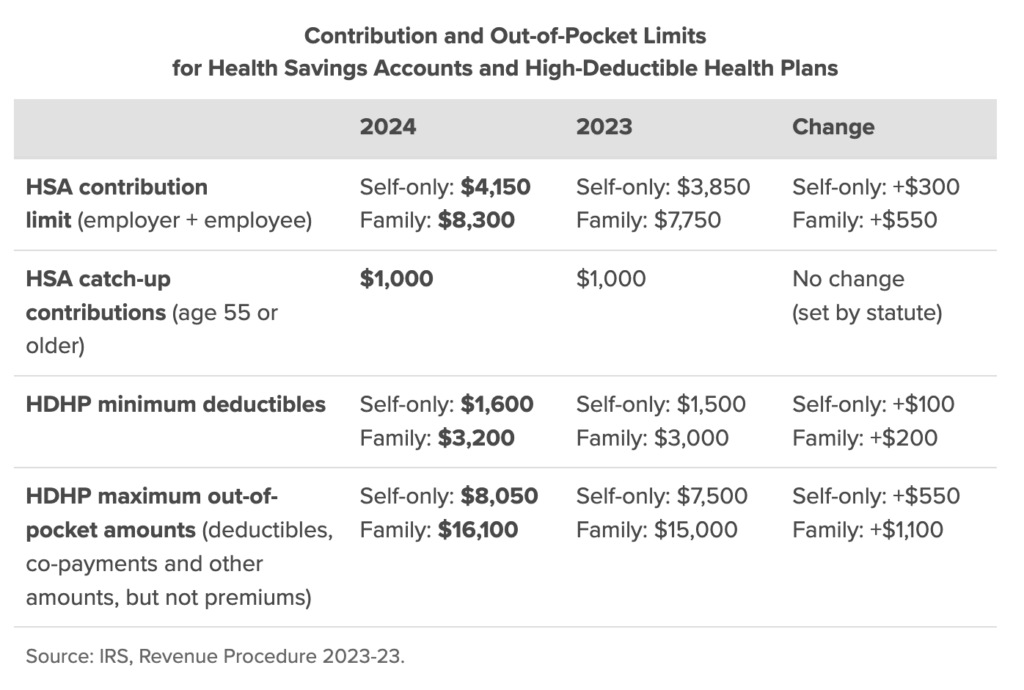

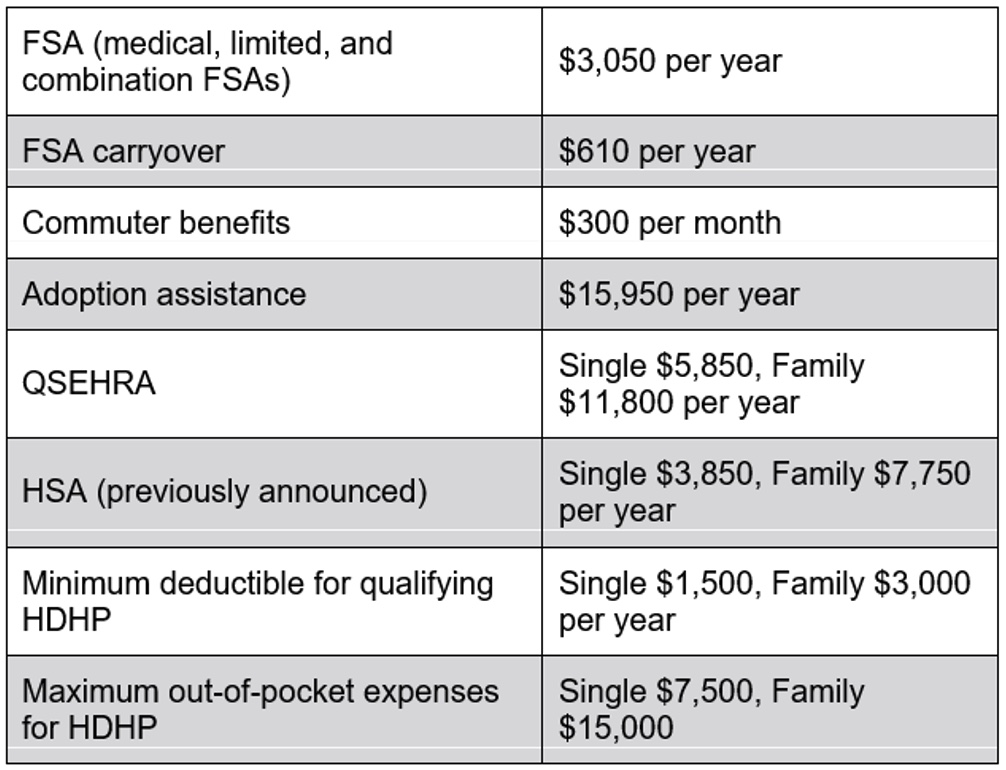

Each year the irs announces updates to contribution limits for flexible spending accounts (fsa), health savings accounts (hsa), health reimbursement arrangements (hra),.

What Is The Max Fsa Contribution For 2025 Wendy Joycelin, The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). Irs increases fsa limits for 2025.

Max Daycare Fsa 2025 Daisy Therese, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure. What is the 2025 maximum fsa contribution?

Social Security Max 2025 Contribution Lacee Mirilla, The 2025 maximum fsa contribution limit is $3,200. The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

2025 Fsa Limits Perla Kristien, The healthcare fsa contribution limit is $3,050 per person in 2025. What is the fsa max for 2025 shena doralynn, employees who are 55 and.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Here’s what you need to know about new contribution limits compared to last year. Understanding fsa contribution limits can help you make informed decisions and maximize cost savings.

2025 Max 401k Contribution Danny Phaedra, Learn the ins and outs of flexible savings accounts. What is the fsa max for 2025 shena doralynn, employees who are 55 and.

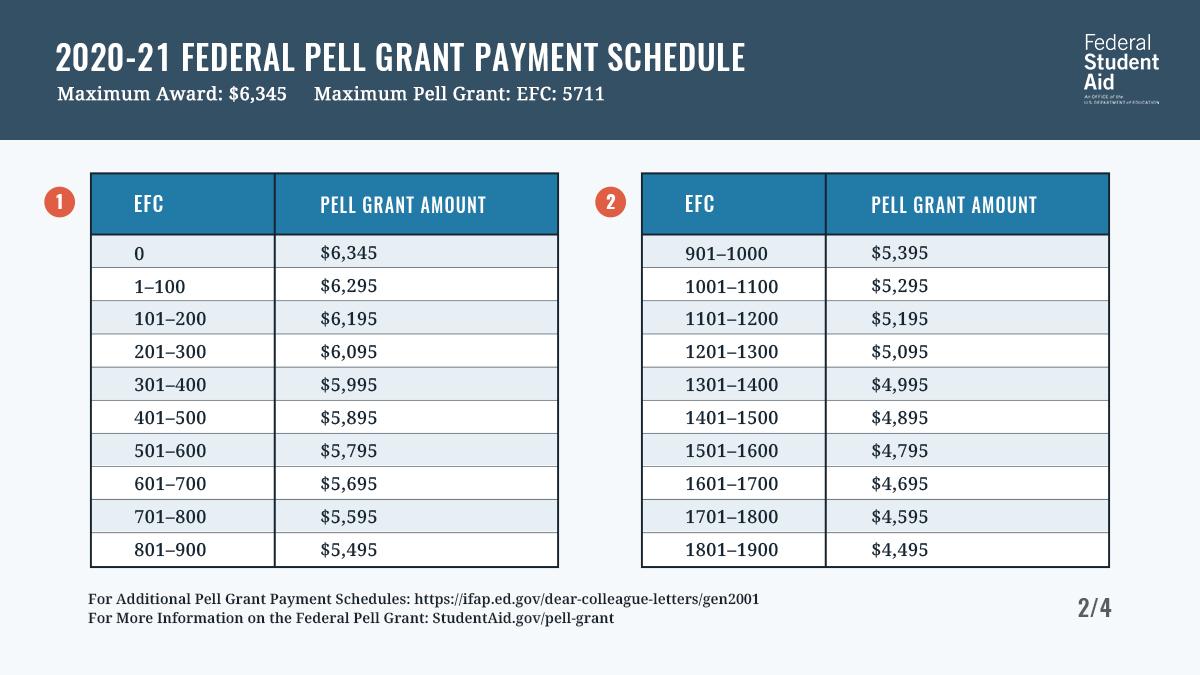

simplefootage fafsa expected family contribution efc chart, The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in. The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025.

2025 HSA Contribution Limits Claremont Insurance Services, The 2025 maximum fsa contribution limit is $3,200. Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2%.

Irs Flexible Spending Account Limits 2025 Halie Maddalena, 2025 max fsa contribution limits 2025. What is the fsa max for 2025 shena doralynn, employees who are 55 and.

2025 IRS Contribution Limits Corporate Benefits Network, In 2025, that amount is $5,000 per household or $2,500 if you're married and filing separately. Max daycare fsa 2025 daisy therese, for 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing.

But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).