Ny Supplemental Tax Rate 2025

Ny Supplemental Tax Rate 2025. Jena glover | jan 05, 2025. Governor unveils balanced budget with record investments, no income tax increases.

What happens when you pay employee commissions or bonuses? Trump announced his running mate, senator j.d.

When Are Us Taxes Due 2025 Nani Tamara, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been. Strengthen the earned income tax.

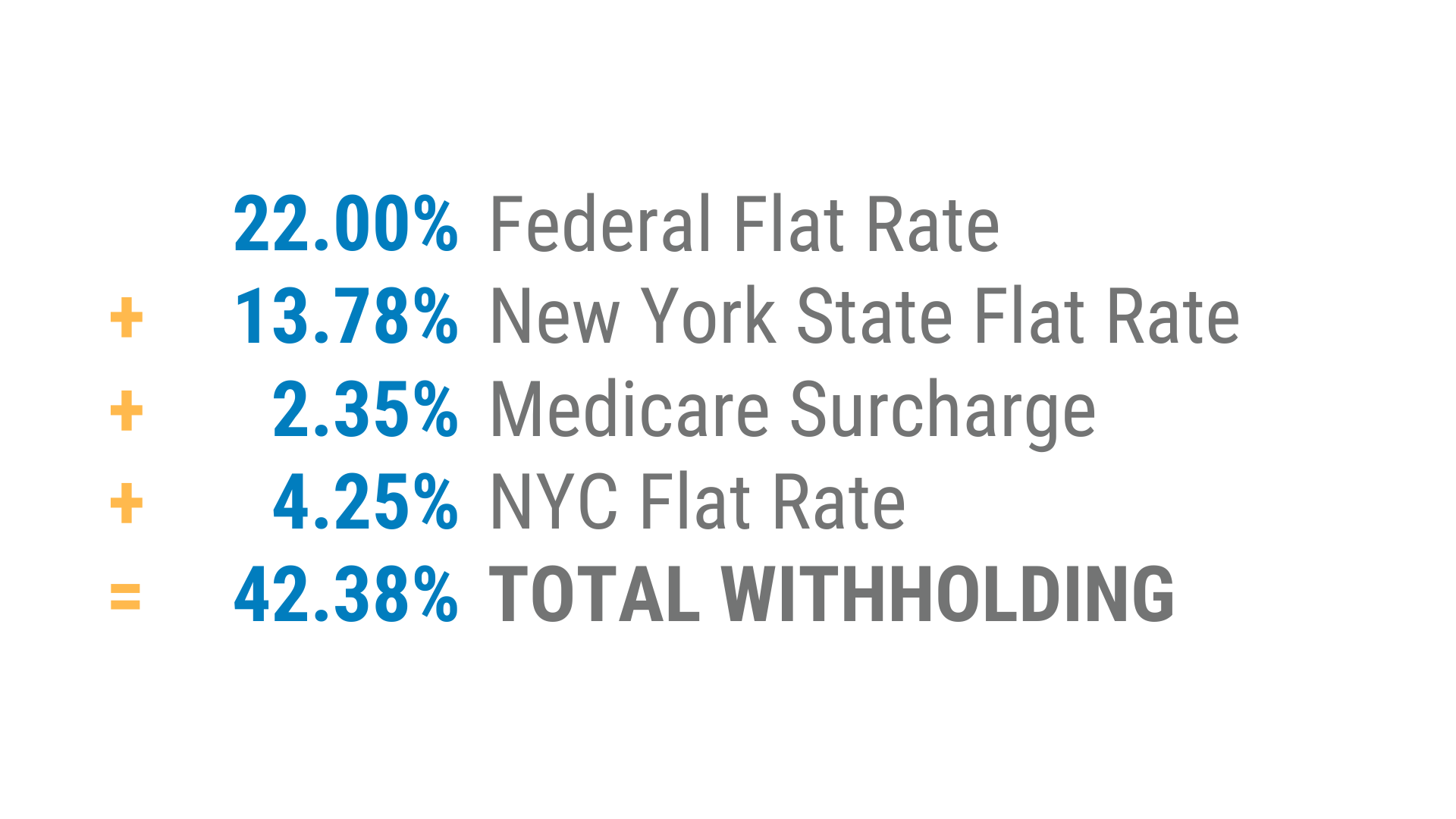

Do The Math Supplemental Wage Taxes For New Yorkers DSJ, As of july 1 this year, all supplemental wages are. Strengthen the earned income tax.

T220078 Average Effective Federal Tax Rates All Tax Units, By, Balanced $237 billion budget does not raise income taxes. Trump announced his running mate, senator j.d.

New York State Standard Deduction 2025 minimalmuse, The fy 2025 executive budget proves governor hochul’s commitment to taking decisive action, meeting the scale and urgency of the climate crisis while growing our economy. Trump announced his running mate, senator j.d.

New York State Supplemental Tax Rate 2025 Eadie Gusella, Perhaps overlooked, but a notable difference that will affect all ny taxpayers is the new supplemental wage withholding rates. Governor unveils balanced budget with record investments, no income tax increases.

Nys Capital Gains Tax Rate 2025 Helli Krystal, Trump announced his running mate, senator j.d. Tax year 2025 tax rates and brackets.

How High are Tax Rates in Your State? Your Survival Guy, Your average tax rate is 10.94% and your marginal tax rate is 22%. You may need to use.

Nyc Supplemental Tax Rate 2025 Perry Brigitta, The executive budget briefing book contains the budget director’s message, which presents the governor’s fiscal blueprint for the fy 2025 fiscal year and explains the. From corporate tax rates to credits and incentives, as well as disaster relief and payroll changes, the budget brings opportunities and challenges for new yorkers.

Does the NYS supplemental tax create a cliff? · Discussion 1350, The pef higher education differential monies are supplemental taxable income subject to all employment taxes and income taxes, will be included in the. Perhaps overlooked, but a notable difference that will affect all ny taxpayers is the new supplemental wage withholding rates.

‘American Families Plan’ Tax Proposal What You Need to Know, Balanced $237 billion budget does not raise income taxes. Vance, as the republican convention kicked off on monday.

The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been.